In its seventh edition, the Responsible Investment Brand Index 2025 evaluates 623 asset managers worldwide and highlights a positive, albeit contrasting dynamic, with the proportion of laggards falling to a three-year low among the notable findings

The Responsible Investment Brand Index (RIBITM) 2025 highlights a major shift in responsible investment. It is no longer just about checking ESG compliance boxes, but about asserting a clear and sincere identity.

In a year marked by polarisation in global finance and escalating scrutiny of ESG, the RIBI 2025 report signals continued momentum – though not without growing pains. The asset management industry is maturing into Responsible Investment 2.0, where authenticity, consistency and strategic clarity increasingly define leadership.

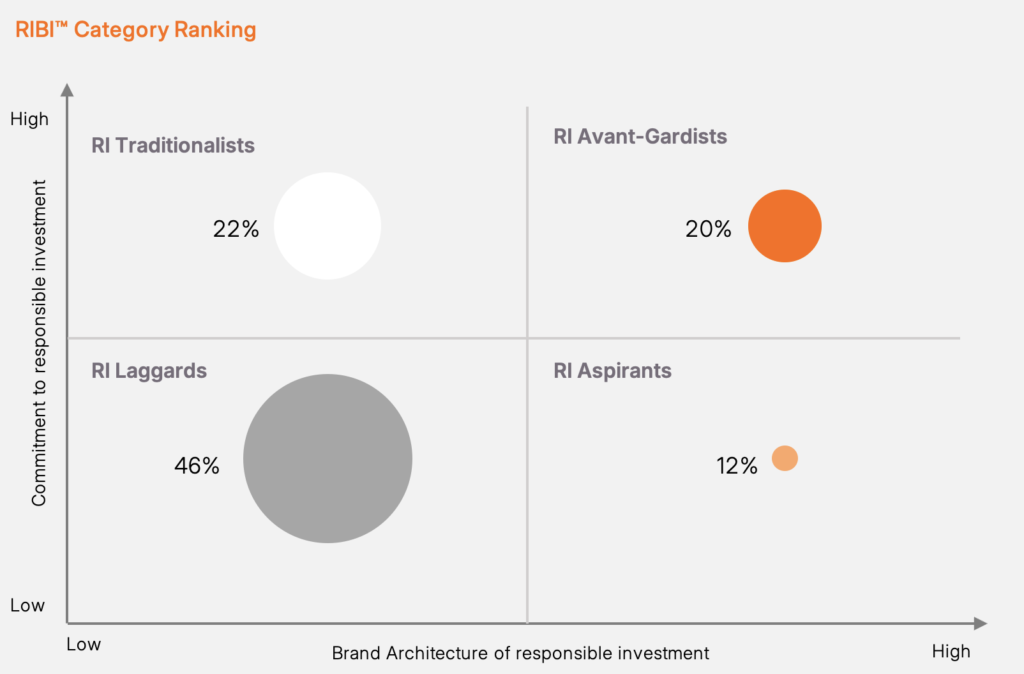

RIBI evaluates asset managers on two key dimensions: Commitment (vertical, hard factors based on UN PRI data) and Brand (horizontal, objectified soft factors). The top category, RIBI Avant- Gardists, reserved for firms scoring above average on both axes, remains fiercely competitive. While the percentage of Avant-Gardists held steady at 20%, the expansion of the universe means 30 new firms advanced to this level.

The industry continues to shake off weak performers: the proportion of laggards stands at 46%, a three-year low. This progress, however, masks a divergence: organisations that truly integrate values into their DNA continue to strengthen, while others risk being exposed as reactive or inauthentic.

“In a context of financial polarisation and doubts about ESG, it is essential that asset managers display a strong and sincere identity. Those who succeed build trust and establish themselves as leaders. They reap the benefits of a solid identity: a stable beacon in an ocean of changes,” explains Jean-François Hirschel, co-founder of RIBI and CEO of H-Ideas.

Top 10 Performers in RIBI 2025

1. DPAM

2. CANDRIAM

3. Pictet Asset Management

4. UBS Asset Management

5. Nordea Asset Management

6. Nuveen

7. Mirova

8. Robeco

9. Triodos Investment Management

10. WHEB Asset Management

Seven companies maintain their place in the Top 10, while Nuveen, Mirova and Triodos make their notable entry. Nuveen is also the only American player in the global Top 10.

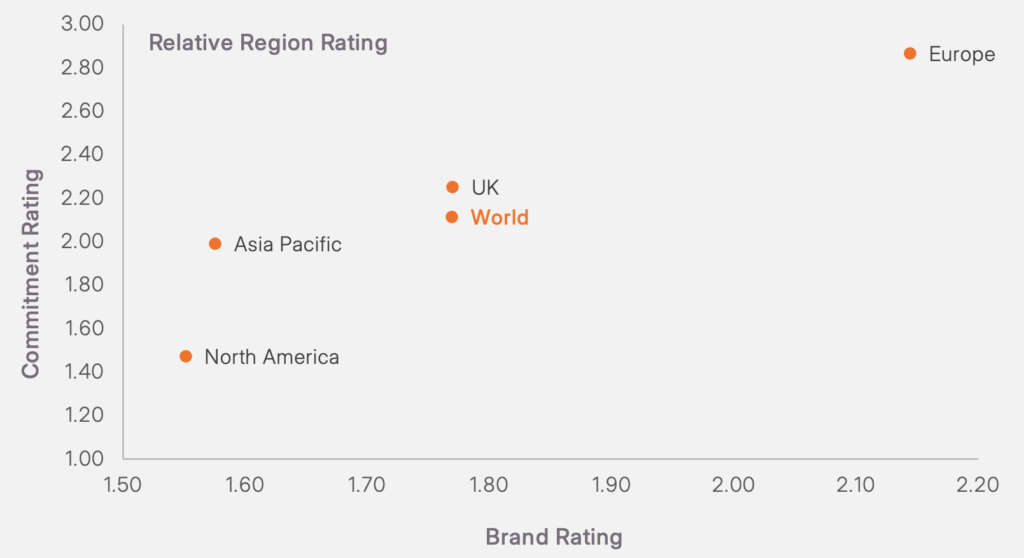

The regional divide continues to deepen

Europe continues to dominate, with both Commitment and Brand ratings well above average

Notable geographic findings include:

- France overtakes Benelux to become the continent’s top-performing sub-region

- Japan shows the best integration of responsible investment, becoming the only country with no laggards

- The United States, despite having the largest number of asset managers, records the highest rate of laggards

- China, although still at a low level, is making significant progress and now scores better than the United States.

New identity frontiers

This year’s data confirms that a declared purpose alone is no longer enough. While 53% of asset managers now articulate one, less than half (45%) back it up with value systems that differentiate and align with it. In a commoditised market, authenticity is emerging as the most sustainable source of strategic distinction. Focus and authenticity in responsible investment, as in branding, are not limitations but rather strengths that build credibility and trust.

“Asset managers who do not go beyond compliance requirements risk being perceived as opportunistic. Conversely, those who deeply anchor responsible investment in their DNA benefit from a sustainable advantage,” emphasises Markus Kramer, co-founder of RIBI and managing partner at Brand Affairs.

The 2025 data underscore a structural split in the industry between those building coherent, principled identities, and those caught between shifting market narratives. RIBI’s unique combination of hard metrics and qualitative analysis makes it a mirror and a map: showing where the industry stands and where it’s headed.

The Responsible Investment Brand Index is the only index that evaluates how well asset managers integrate responsible investment into their corporate brand. The index covers over 600 firms globally, allowing for unique insights across geographies, sizes, and sectors. New in 2025 are specific spotlights on tiered perspectives by size (AUM) and Real Assets divided into Private Assets and Real Estate. Learn more at: ri-brandindex.org

About the index

The Responsible Investment Brand Index (RIBITM) identifies which asset management companies act as responsible investors and commit to sustainable development to the extent that they put it at the very heart of who they are, i.e. in their brand. It aggregates the analysis of over 600 asset managers globally. For a detailed description of the methodology, please refer to the website.

About the authors

Jean-François Hirschel is the founder and CEO of H-Ideas, a company which aims at re-establishing trust in the financial world. Markus Kramer is managing partner at Brand Affairs, a specialist consultancy with expertise in strategic positioning and brand building.