These are the best UK Cities outside London for Finance Graduates

- Cambridge has the most entry-level finance opportunities relative to its population, even higher than London, with 13.5 jobs per 100,000 people.

- Oxford is the 2nd best city outside London to kickstart a career in finance with 5.6 jobs for every 100,000 people.

- Birmingham may be the most attractive option for grads seeking the best opportunities in a more affordable city, as it has the lowest cost of living on the list, while having the 4th highest job per capita index.

Planning for a career in finance in the UK? Most finance graduates set their sights on London, the world’s finance capital. However, other cities have multiple entry-level positions in finance for individuals looking to avoid the high cost of living in London.

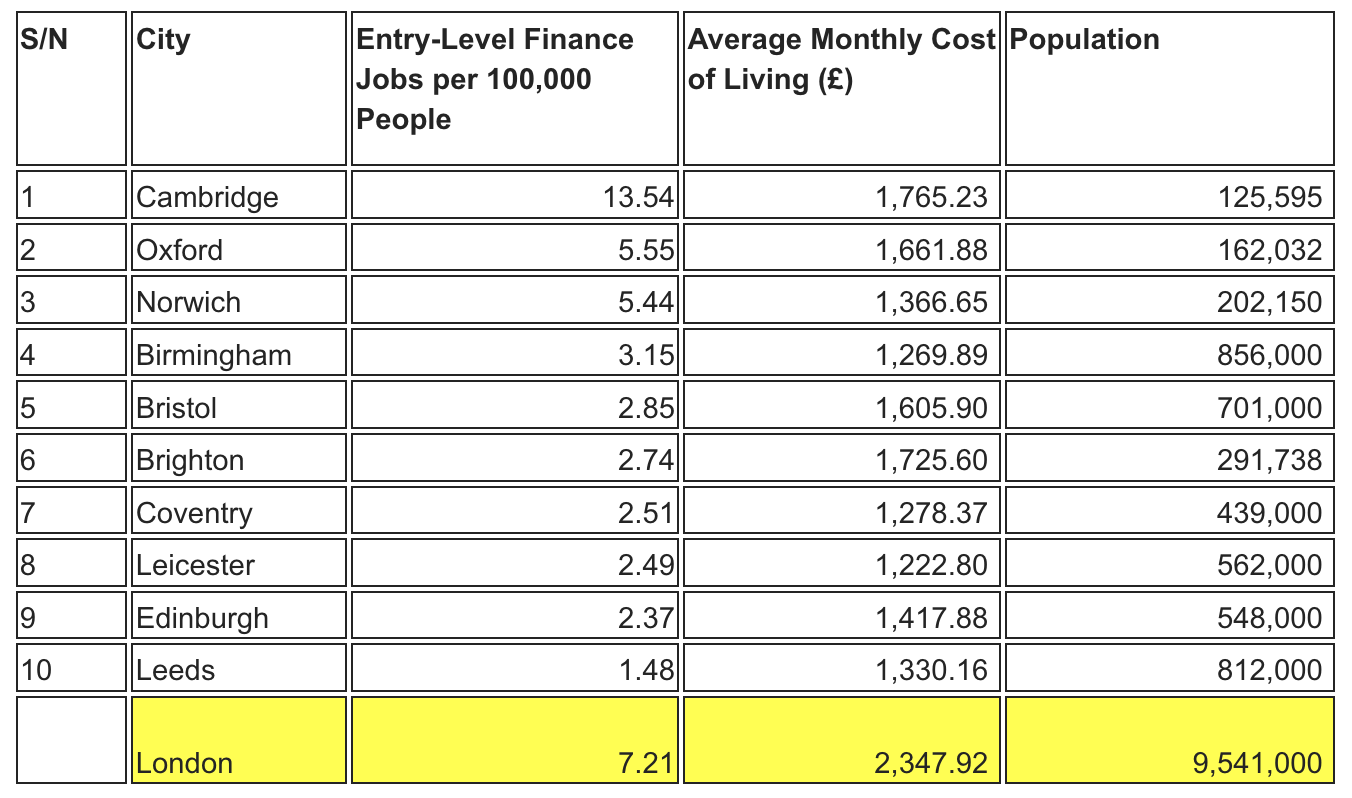

UK financial services provider CMC Markets has analysed data from major job search sites, Indeed and Linkedin, to reveal the UK cities outside of London with the most entry-level vacancies in finance roles. They have also collated cost of living data from Numbeo for these cities to provide the complete picture for decision-making.

Cambridge is the city with the most entry-level finance job openings per capita, even more than London, with 13.5 jobs per 100,000 people. The city with the second most entry-level finance roles outside of London is Oxford, with 5.6 jobs for every 100,000 people. It is, however, worth noting that Cambridge has the highest cost of living on this list, with the average monthly cost of living for one person coming to £1,765.23, including rent for an apartment outside the city centre. Oxford has the third highest cost of living, with monthly expenses for one person, including rent averaging £1,661.88.

Norwich comes in third on the list with 5.4 entry-level finance jobs per 100,000 people and a monthly average cost of living of £1,366.65. Birmingham ranks fourth, with 3.2 finance vacancies for every 100,000 people. Birmingham, however, has the lowest cost of living on the list, with a monthly average cost of £1,269.89, including rent for an apartment outside the city centre.

Bristol has the fifth highest entry-level finance jobs per capita, with 2.9 jobs per 100,000 people and monthly living costs averaging £1,605.90 for one person. Brighton has 2.7 jobs for every 100,000 people and ranks sixth on the list. Coventry has the seventh most entry-level finance jobs per capita with 2.5 jobs per 100,000 people. It is also the second most affordable city on the list, with the average monthly living costs for one person coming to £1,278.37.

Leicester is eighth on the list, and Edinburgh, the only city outside England on the list, has the ninth most entry-level finance jobs per capita with 2.4 jobs per 100,000 people. The 10th city on this list is Leeds; it is also the third most affordable city on the list, with average monthly costs of £1,330.16 for one person.

People determined to have the London experience will find no shortage of opportunities, with 7.2 entry-level finance jobs per 100,000 people. Of course, they will have to consider the high cost of living at £2,347.92, including rent for a one-bedroom flat outside central London.

All credit for this article to – https://www.cmcmarkets.com/en-gb/